40+ Mortgage calculator with origination fee

No application origination or disbursement fee Fixed interest rate Starting at 349 Variable interest rate. Note that the interest rate is different from the Annual Percentage Rate APR which includes other expenses such as mortgage insurance and the origination fee and or points which were paid when the mortgage was first originated.

Oqlip8vtnyqw2m

These fees are typically incremented by half-percent.

. The origination fee reduction 200 for Gold tier 400 for Platinum tier and 600 for Platinum Honors tier will not exceed the amount of the Lender Origination Fee. Historical Current United States Residential Mortgage Origination Loan Servicing Statistics for 2022. In terms of mortgage affordability the VA loan is hard to beat if youre.

VA mortgage rates can often be as much as 40 basis points 040 lower than rates for a comparable conventional loan. How much income you need depends on your down payment loan terms taxes and insurance. Use Bankrates loan comparison calculator to get a clear picture of all relevant costs.

2020 the FHFA allowed the GSEs Fannie Mae and Freddie Mac to pass on a 50 basis point adverse market conditions fee for most mortgage refinances with a balance above 125000. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. The origination process typically comes with a fee known as the mortgage origination fee often equal to 05 percent to 1 percent of the loan principal.

A large portion of your closing costs are paid to the lender and are known as. This entry is Required. All inputs and options are explained below.

When you take out a mortgage you agree to pay the principal and interest over the life of the loan. And loan origination fees. By 1933 around 40 to 50 percent of all residential mortgages in the United States were in default.

For example if you buy a house worth 450000 the closing cost can be anywhere between 13500 to 27000. The home loan calculator accounts for mortgage rates loan term down payment more. Mortgage loan basics Basic concepts and legal regulation.

Forbes Advisors Mortgage Calculator uses home price down payment and other loan details to give you an estimate calculation on your monthly mortgage payments. Mortgage borrowers can count on average fees and competitive interest rates tracking just below the national average. The most common fee is 1 though the maximum loan origination fee is 3 on Qualified Mortgages of 100000 or more.

It can get expensive so its best to prepare more funds. With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

In an effort to strengthen the residential mortgage market Congress passed the National Housing Act of 1934. Most mortgage lenders charge an origination fee which is usually around 1 of the total cost of the loan. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

New York City Yonkers and several other cities also impose a local tax on mortgages in those jurisdictions. Mortgage Calculator How Much House Can I Afford. The delinquency rate was 638 of all mortgage loans outstanding at the end of the first quarter of 2021.

Enter an amount between 0 and 25. The state tax is 50 cents per 100 of mortgage debt plus an additional special tax of 25 cents per 100 of mortgage debt. Second mortgage types Lump sum.

Todays national mortgage rate trends. The 366 days in year option applies to leap years otherwise. On Thursday September 01 2022 the current average rate for a 30-year fixed mortgage is 595 rising 3 basis points over the last seven days.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The Federal Housing Administration FHA and the Federal Savings Loan Insurance Corporation.

Commercial lenders pay a fee for the time their staff dedicate to underwriting and processing a loan request. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period. Borrowers can also get a preapproval letter within 24 to 48 hours and they.

Calculate your monthly payment here. This typically costs around 500 to 2500. Smaller homes may see a higher origination fee on a percentage basis since the mortgage broker will need to do a similar amount of work for a smaller loan amount.

When DTI is surging past 40 it could be a sign that you need to increase your income or look for a more affordable home. Lenders will tolerate a DTI up to 50. Mortgage Calculator How Much House Can I Afford.

For example your annual program fee for your Merrill Guided Investing account could go from 045 to 040. That fee must be stated in the term sheet and is usually paid upfront or via deposit once the loan term is implemented. Our mortgage calculator helps you estimate your monthly mortgage payments.

Second mortgages come in two main forms home equity loans and home equity lines of credit. 30 to 40 days for purchase closings although the lender can accommodate shorter timeframes if needed. 30 to 40 days for purchase.

This fee was implemented to help protect the GSEs from an. In addition to. Mortgage Calculator Found a home you like.

This fee might be as high as 2 percent if. If the property is located in a city or town that has mortgage tax youll pay an additional 25 to 50 cents. The lender then takes the property and recovers the amount of the loan and also keeps the interest and principal payments as well as loan origination fees.

Our mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments the total costs of refinancing and how long it will take to recoup those costs. The origination fee is higher than most. Use SmartAssets free California mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

Best for Customizing Loan Payment. This paved the way for two new agencies. No foreign transaction fees.

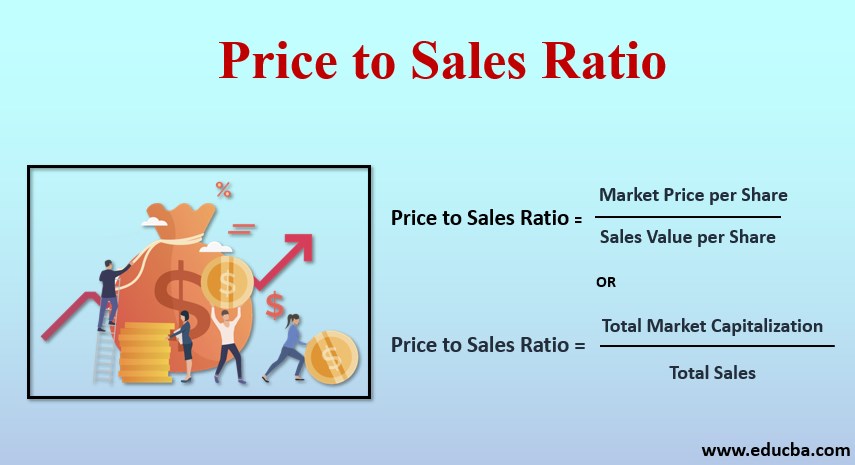

Price To Sales Ratio How To Calculate Price To Sales Ratio Examples

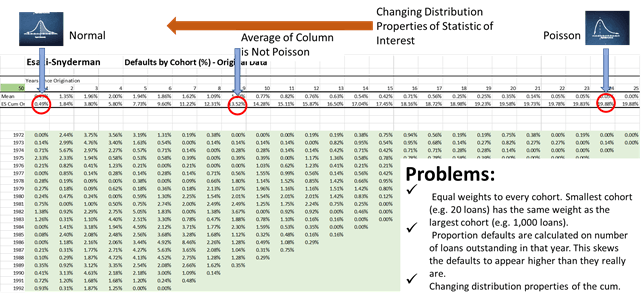

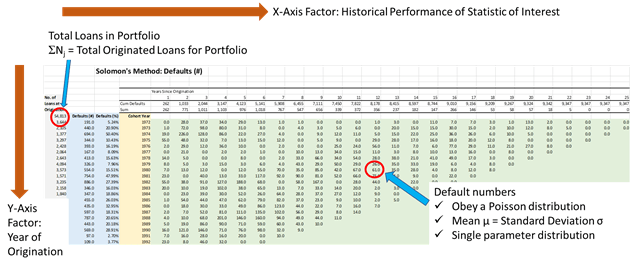

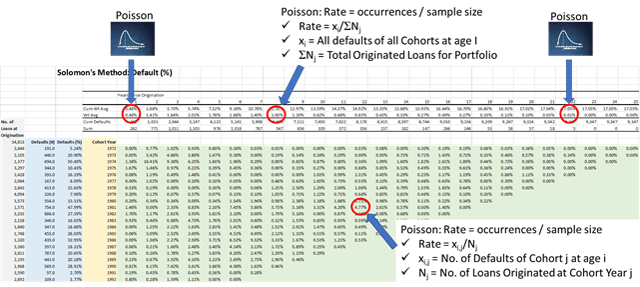

Solomon S Method For Collated Distributions Used In Mortgage Backed Securities Nysearca Cmbs Seeking Alpha

Edward Richey Senior Business Analyst Amerifirst Home Mortgage Linkedin

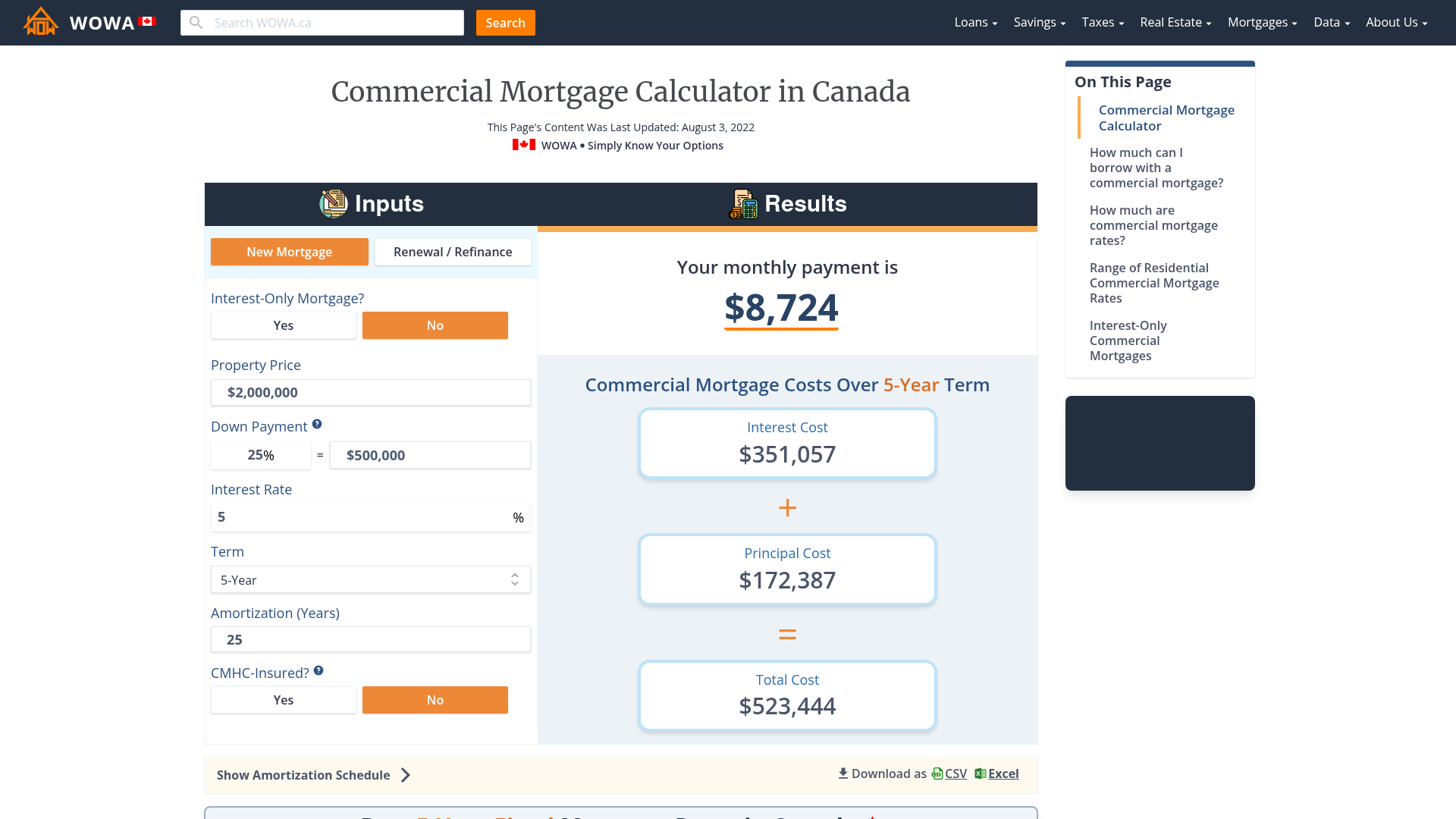

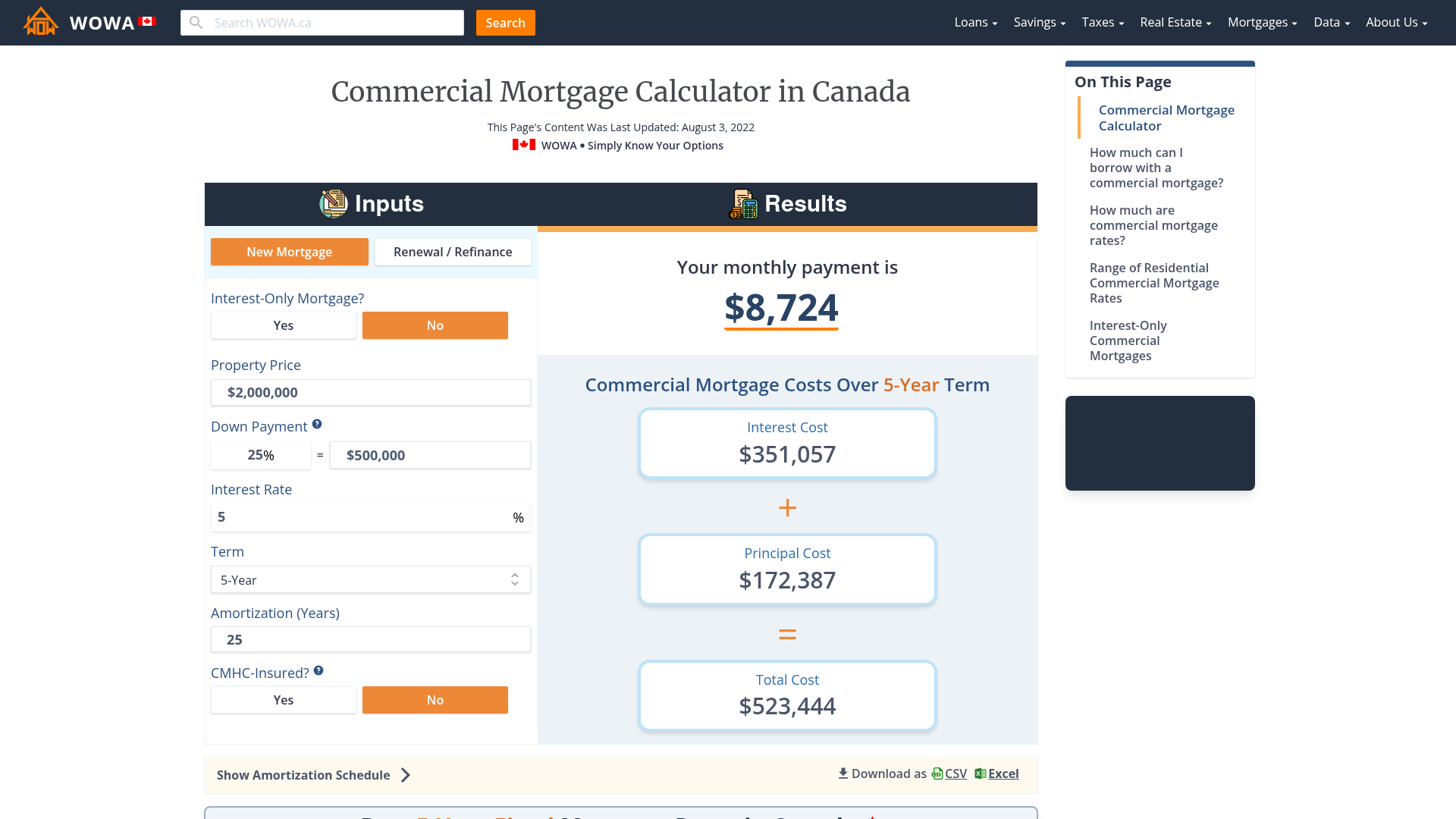

Commercial Mortgage Calculator Payment Amortization

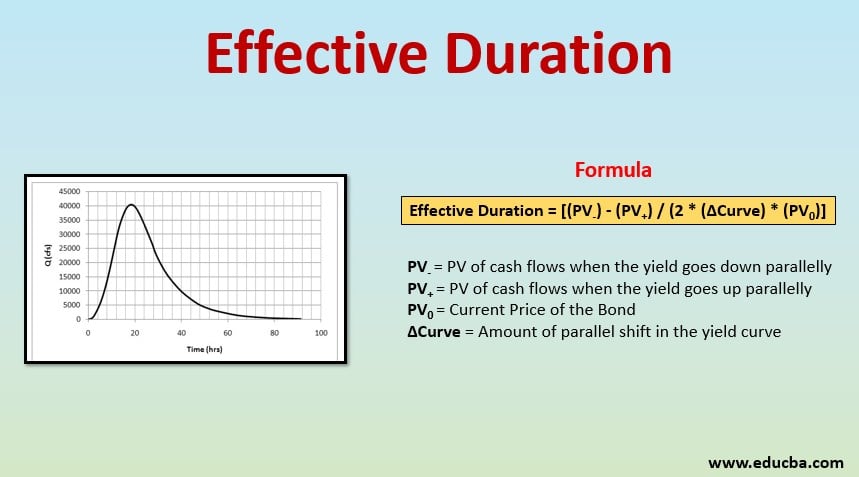

Effective Duration Formula How To Calculate Effective Duration

Solomon S Method For Collated Distributions Used In Mortgage Backed Securities Nysearca Cmbs Seeking Alpha

Pin By Akbanknotes On Loan Applications Mortgage Process Mortgage Loan Originator Mortgage Loans

Schedule A Demo The Mortgage Office

Mortgage Comparison Spreadsheet Mortgage Comparison Refinance Mortgage Mortgage

Effective Interest Rate Formula Calculator With Excel Template

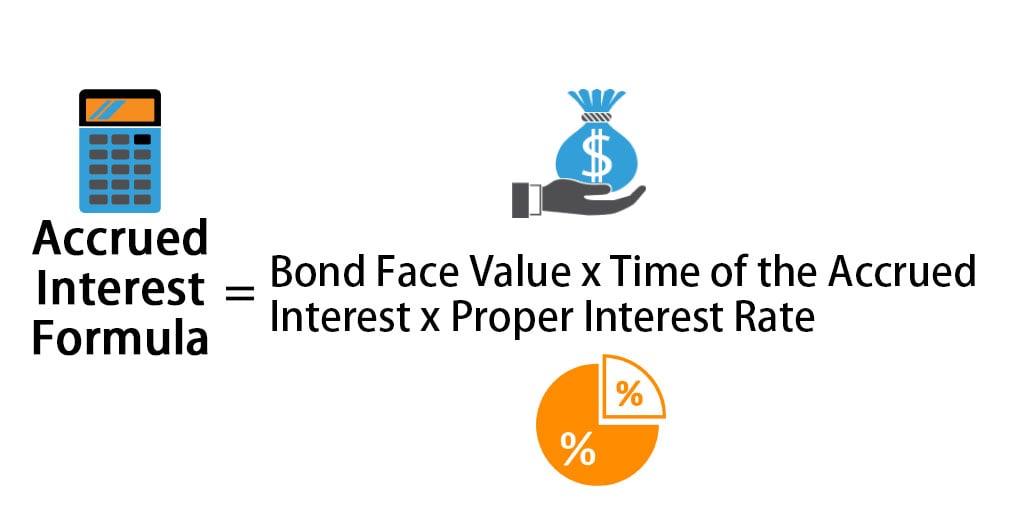

Accrued Interest Formula Calculator Examples With Excel Template

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

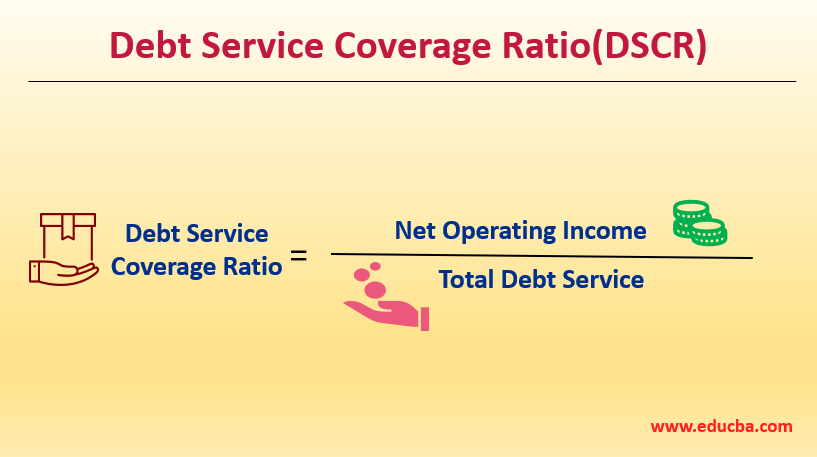

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

Home Insurance Insurance Policy Mortgage Loan Rent Contract Icon Mortgage Loans Home Insurance Mortgage

Keep Calm Your Mortgage Is Clear To Close Mortgage Quotes Mortgage Humor Mortgage

Solomon S Method For Collated Distributions Used In Mortgage Backed Securities Nysearca Cmbs Seeking Alpha

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer